Target Savings

Structured savings plans that help you save with purpose

UnionKorrect

The UnionKorrect account is a tenured savings plan offering a structured approach to saving, ensuring your funds grow steadily over a specified period while giving you a chance to win exciting cash prizes.

Account Features & Benefits

- Minimum of ₦5,000 monthly contribution.

- 5.90% interest rate per annum

-

Bi-annual draws for savings tenure of 48 months:-1 customer will be rewarded with ₦500,000- First Prize-40 customers will be rewarded with ₦50,000- Second Prize-100 customers will be rewarded with ₦25,000- Third Prize

Account Opening Requirements

- Existing Union Bank savings or current account

- Duly completed target savings (TSP) account opening form

- Email instruction to customerservice@unionbankng.com

UnionKorrect Dai-Dai

The UnionKorrect Dai Dai account is a tenured savings plan designed to promote financial inclusion and encourage disciplined savings habits among individuals with low disposable income, particularly in Northern Nigeria.

Account Features & Benefits

- Minimum of ₦1,000 monthly contribution.

- 5.90% interest rate per annum

- Bi-Annual Draws for savings tenor of 24 months

– 1 customer will be rewarded with ₦100,000- First Prize

– 24 customers will be rewarded with ₦20,000 -Second Prize

– 200 customers will be rewarded with ₦10,000 -Third Prize

Account Opening Requirements

- Existing Union Bank savings or current account

- Duly completed target savings (TSP) account opening form

- Email instruction to customerservice@unionbankng.com

UnionFuture

This is a tailored savings product designed to offer individuals, particularly those without formal payroll structures and retirement savings plan. It is perfect for self employed individuals, traders, farmers looking to save and prepare for the future.

Account Features & Benefits

- Free life insurance cover of ₦100,000 at the attainment of ₦100,000 savings contribution.

- Minimum monthly contribution of ₦2,000 Monthly

- 5.90% interest rate per annum

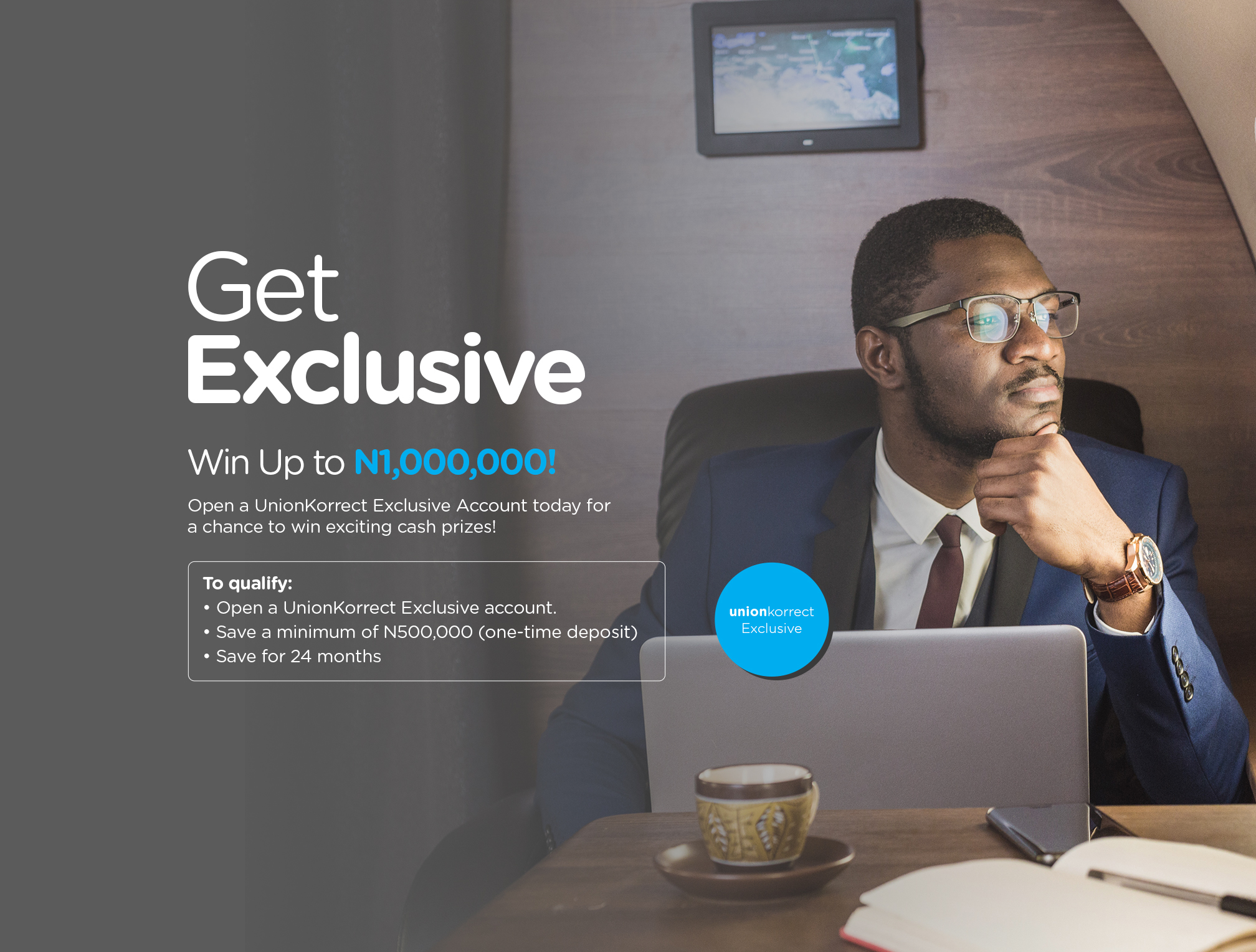

UnionKorrect Exclusive

This account is ideal for individuals looking to save a lump sum of ₦500,000 or more to earn higher interest rates and exclusive benefits over a fixed period of 24 months.

Account Features & Benefits

- 24 months saving tenor

- 9.25% interest rate per annum

-

Exclusive- Annual Rewards-1 customer will be rewarded with ₦1m- First price-10 customers will be rewarded with ₦500,000- Second price-75 customers will be rewarded with ₦100,000- Third price

Account Opening Requirements

- Existing Union Bank savings or current account

- Duly completed TSP account opening form

- Email instruction to customerservice@unionbankng.com

UnionBetta

Account Features & Benefits

- Free life insurance cover of ₦100,000 at the attainment of ₦100,000 savings contribution.

- Minimum monthly contribution of ₦2,000 Monthly

- 5.90% interest rate per annum

UnionFlex

Save on your own terms with UnionFlex. It is ideal for individuals looking for a flexible and personalised savings plan. If you like to have control over your savings duration and deposit amounts, UnionFlex is the perfect fit for your unique financial needs.

Account Features & Benefits

- 6-60 months saving tenor

- 5.90% interest rate per annum

- Initial contribution of ₦20,000 and

- Subsequent (minimum) contribution of ₦10,000

Account Opening Requirements

- Existing Union Bank savings or current account

- Duly completed TSP account opening form

- Email instruction to customerservice@unionbankng.com